Fiscal Policy - The Student Room.

ACTIVITY 1: VIDEO - FISCAL POLICY KEY TERMS REMINDER. In this video, we'll work through a simple game to remind you of some of the key terms associated with fiscal policy. You will need to feel confident with these key terms ahead of moving through the rest of this online lesson.

Fiscal policy has a clear effect upon output. But there is a secondary, less readily apparent fiscal policy effect on the interest rate. Basically, expansionary fiscal policy pushes interest rates up, while contractionary fiscal policy pulls interest rates down. The rationale behind this relationship is fairly straightforward. When output.

Economics Cafe provides economics model essays which are not confined to use by students taking economics tuition at the learning centre. They have been written by the Principal Economics Tutor, Mr. Edmund Quek, for everyone who can benefit from them.As the essays were written with the examination time constraint in mind, every essay has room for improvement in the absence of time constraint.

Types of fiscal policy. Fiscal policy is the deliberate adjustment of government spending, borrowing or taxation to help achieve desirable economic objectives. It works by changing the level or composition of aggregate demand (AD). There are two types of fiscal policy, discretionary and automatic.

Thanks to President Donald Trump’s tax cuts, the federal deficit will exceed 4% of GDP this year, a level that is more typical after economic slumps than in the benign conditions seen today.

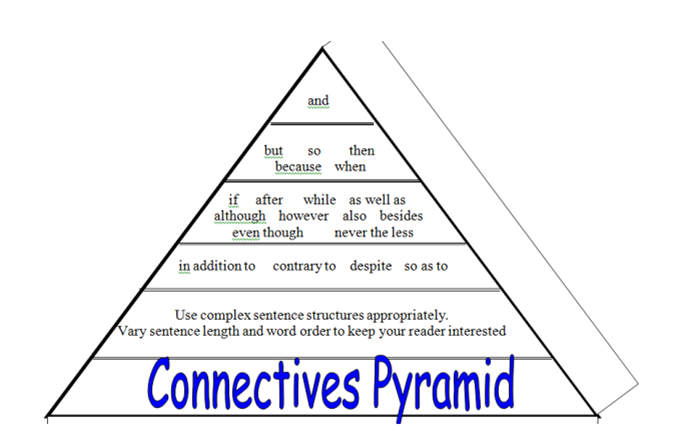

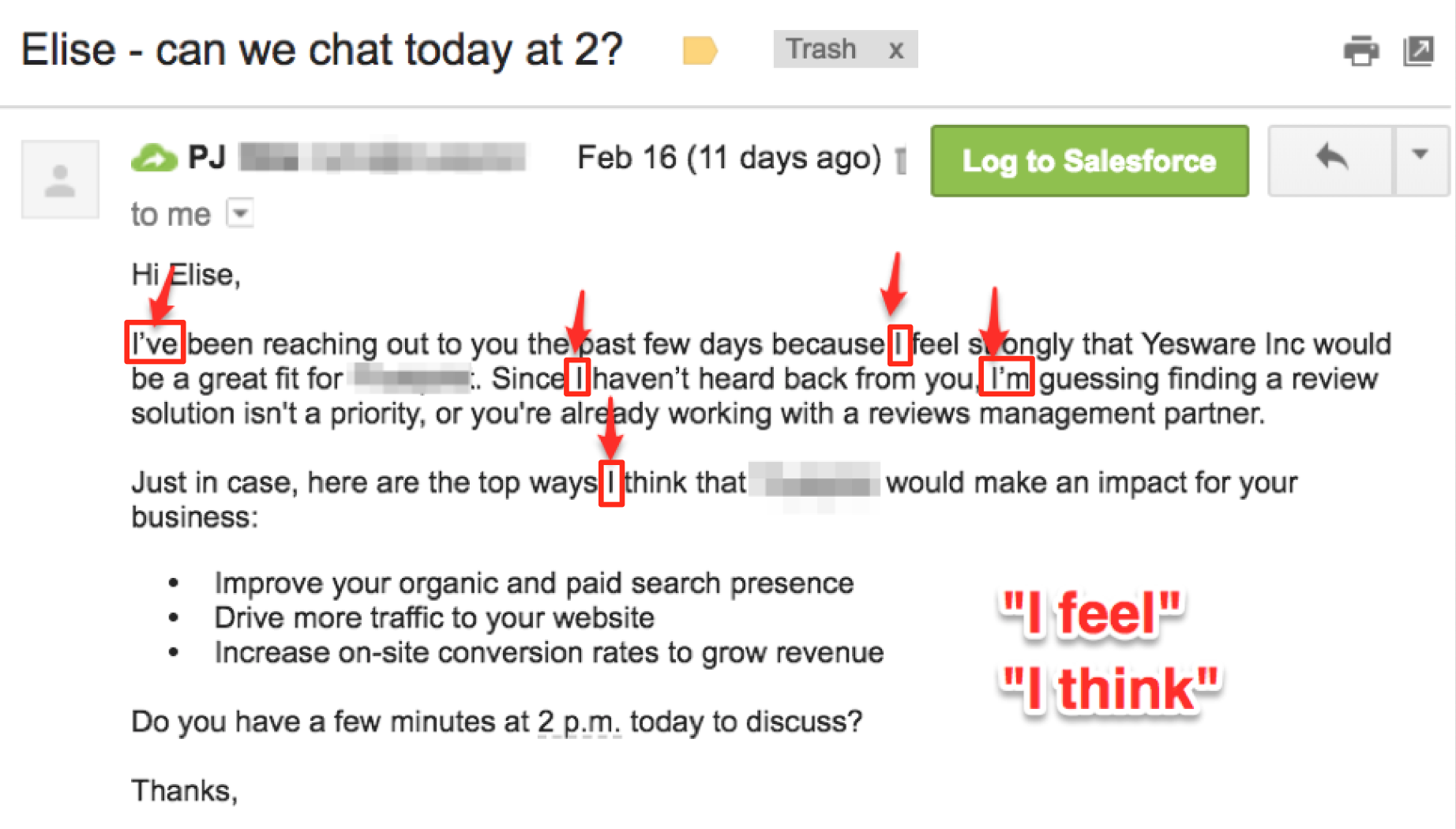

No you don’t have to take A Level Mathematics alongside Economics, although it can be advantageous. It might be worth considering Core Maths (AS) to support you. Will I have to write essays in Economics? Yes, the assessment of Economics is heavily focussed on essays and hence throughout the course you will be developing your essay writing skills.

A-level: Content for Paper 1. Paper 1 looks at microeconomics. There are limited changes to the current AQA A-level Economics specification. Individual economic decision making is one new area. Much of the content is identical to the current AQA A-level Economics specification, but has been clarified and modernised. Slide 12.

I'm an international student in India, teaching myself the CIE a level French curriculum. CIE has no recommended textbook designed specifically for the a level in French, and the a level is linear, not modular. How do you suggest I go about teaching myself. The literature is fairly manageable, but paper 2 (reading) is KILLING me.

Economics Curriculum Intent GCSE and A Level Economics is a subject which will be new to most students who take it. It introduces our students to some new ways of looking at the world and some new techniques of analysing what you see. The task of an economist is then to use this.

It is important to note that fiscal policies are often used alongside monetary policies, as fiscal policies should not be predominantly used to control prices as this is the role of monetary policy. However, it is important to note that the long-run impact of a fiscal policy all depends on the sectors of the economy that the policy has targeted.

Essay Fiscal Policy And Monetary Policy. how it will work. There are different ways of handling these issues. Fiscal policy and monetary policy are to solutions figuring out which one is the answer is always a challenge due to all of the different views and theories on economics.

Economics A Level- Okehampton College What can the course lead to in terms of higher education and future careers? Why is economics a useful subject to study? Economics develops a range of generic skills such as research, data handling, applying theoretical concepts to real life scenarios, essay writing and problem solving. The subject.

A Level and AS Level Economics revision notes, worksheets, data response questions, past year papers, crosswords, mindmaps and tons for resources for teachers and students.